Best Auto Insurance in the USA

In the hustle and bustle of everyday life, having reliable auto insurance is not just a choice; it’s a necessity. Whether you’re a seasoned driver or a newcomer on the road, understanding the nuances of auto insurance in the USA can be a game-changer. This comprehensive guide is your roadmap to finding the best auto insurance, tailored to your needs and preferences.

Enter “Webster Solution” – a name gaining prominence in the realm of auto insurance solutions. But what sets them apart? Why should you consider Webster Solution for your auto insurance needs? Let’s dive into the details.

Understanding Auto Insurance Basics

Auto insurance typically covers damage to your vehicle, liability for injuries or damage you might cause to others, and other unforeseen circumstances. Knowing the different types of coverage available, including comprehensive coverage, is essential for making informed decisions about your policy.

Importance of Auto Insurance

Auto insurance is more than just a legal requirement; it’s a safety net that protects you and your assets in the event of unforeseen circumstances. From fender benders to major accidents, having the right coverage ensures financial security and peace of mind.

How Choosing the Best Auto Insurance in the USA

The United States boasts a plethora of auto insurance options, each claiming to be the best. Navigating through the choices can be overwhelming, but fear not – we’re here to simplify the process.

“Webster Solution” takes a unique approach to auto insurance, offering a range of features and benefits designed to meet the diverse needs of policyholders. Whether it’s their competitive rates, flexible coverage options, or stellar customer service, Webster Solution has positioned itself as a reliable choice in the market.

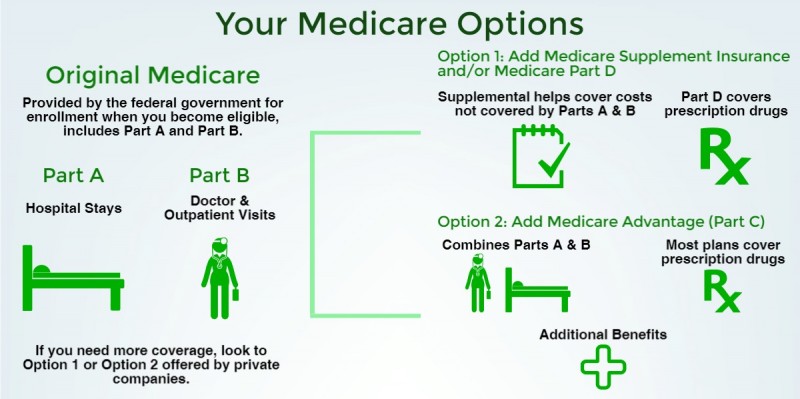

Liability Coverage

Liability coverage is the bedrock of any auto insurance policy, covering damages you might cause to others on the road. Understanding the limits and requirements in your state is crucial for responsible coverage.

Collision Coverage

When your vehicle meets an unfortunate collision, this coverage steps in to handle repair costs. Knowing when and how collision coverage applies is key to making informed decisions.

Comprehensive Coverage

From natural disasters to theft, comprehensive coverage extends beyond collisions. Unravel the layers of protection it provides for a holistic approach to insurance.

State-Requirements

Auto insurance requirements vary from state to state. Familiarize yourself with your state's mandates to ensure compliance and avoid unnecessary penalties.

Here, we break down the different types of coverage on “Webster Solution,” helping you make an informed decision based on your unique needs.

How Choosing the Best Auto Insurance in the USA

- Driving Record: Your driving history is a major player in determining insurance rates. Safe driving not only keeps you and others secure but also saves you money on premiums.

- Vehicle Type:The make and model of your vehicle influence insurance rates. Luxury cars may command higher premiums, while safety features can earn you discounts.

- Location:Where you live matters. Urban areas may come with higher risks, impacting insurance rates. Understand the geographical factors that play a role in your premiums.

- Credit Score:Believe it or not, your credit score affects your auto insurance rates. Learn how to maintain good credit for favorable insurance pricing.

Comparing Auto Insurance Quotes

Importance of Comparison

Don’t settle for the first quote that comes your way. Understand the significance of comparing multiple quotes to find the most cost-effective and comprehensive coverage.

Online Tools and Resources

Explore the convenience of online tools that simplify the comparison process. Leverage technology to make an informed decision about your auto insurance.

Steps to Secure Auto Insurance with Webster Solution

Making the decision to choose “Webster Solution” is one thing; navigating the process of securing auto insurance with them is another. We’ll guide readers through the easy sign-up process, customization options, and the user-friendly interface that Webster Solution offers.

Bundling Policies

Bundle your insurance policies for potential discounts. Discover the perks of consolidating your coverage under one provider.

Defensive Driving Courses

Investing in defensive driving courses not only enhances your safety skills but can also lead to lower insurance premiums. Uncover the benefits of proactive driving education.

Increasing Deductibles

Adjusting your deductibles can impact your premiums. Learn the art of finding the right balance between out-of-pocket expenses and monthly costs.

Step-by-Step Guide

Navigating the claims process can be daunting. Follow a step-by-step guide to ensure a smooth and hassle-free experience when filing an auto insurance claim.

Common Mistakes to Avoid

Learn from the mistakes of others. Understand common errors made during the claims process and safeguard your interests.

Usage-Based Insurance

Explore the rise of usage-based insurance models. Understand how technology is revolutionizing the way auto insurance is priced and structured.

Technology Integration

From telematics to AI, technology plays a pivotal role in the evolving landscape of auto insurance. Stay informed about the latest tech trends shaping the industry.

Future of Auto Insurance

Autonomous Vehicles Impact

As autonomous vehicles become more prevalent, discover how the landscape of auto insurance is adapting to this revolutionary change.

Evolving Coverage Models

The future brings new possibilities in coverage models. Stay ahead of the curve by understanding the potential shifts in auto insurance offerings.

Staying Informed About Policy Changes

Regularly Reviewing Policies

Auto insurance policies can undergo changes. Stay proactive by regularly reviewing your policy to ensure it aligns with your current needs.

Staying Updated on Industry Changes

Auto insurance policies can undergo changes. Stay proactive by regularly reviewing your policy to ensure it aligns with your current needs.

Final Thoughts

Securing the best auto insurance involves a combination of understanding the basics, considering provider advantages, and being aware of market trends. “Webster Solution” emerges as a compelling choice, backed by positive customer experiences, technological innovations, and exclusive offers.

Frequently Asked Questions (FAQs)

It’s advisable to review your policy annually or whenever there are significant life changes, such as a new vehicle purchase or a change in your driving habits.

Comprehensive coverage provides extensive protection beyond collisions, making it valuable, especially if you live in an area prone to natural disasters or theft.

Yes, your credit score can impact your auto insurance rates. Maintaining a good credit score can contribute to lower premiums.

Pay attention to reviews that highlight customer service, claims processing, and overall satisfaction. Look for patterns and consider multiple sources for a balanced perspective.

The impact of autonomous vehicles on insurance rates is still evolving. While some aspects may change, it’s essential to stay informed about industry developments.

Unlock potential savings by exploring the various discounts offered with the best auto insurance on “Webster Solution.” This section unveils opportunities to make your coverage more cost-effective.